When most people think about building wealth, real estate often comes to mind. It’s tangible, it’s lucrative (in the right market), and it’s something that’s been generating income for investors for centuries. But how do you get started? How do you build a real estate portfolio that grows over time, reduces risk, and generates consistent income?

We’re diving into the essentials of building a real estate investment portfolio, from understanding the basics to selecting the right properties and managing risk. Whether you’re a first-time investor or someone looking to expand your existing portfolio, I will walk you through the steps to build a successful and diversified real estate investment strategy.

Why Invest in Real Estate?

Real estate isn’t just about owning property or getting rental income—it’s a multifaceted investment that offers a combination of capital appreciation, passive income, tax advantages, and inflation protection. Here are some of the reasons why real estate is often a key component of a successful investment strategy:

- Tangible Asset: Unlike stocks or bonds, real estate is a physical asset that you can touch, see, and manage.

- Steady Cash Flow: Rental income provides a reliable source of passive income.

- Capital Appreciation: Real estate values generally rise over time (though not always). Over the long term, properties tend to appreciate, contributing to wealth accumulation.

- Tax Advantages: Real estate investments come with several tax perks, such as depreciation, mortgage interest deductions, and the ability to 1031 exchange properties for tax deferral.

- Inflation Hedge: Real estate generally performs well during inflationary periods. As prices rise, so do rents and property values.

- Diversification: Real estate offers diversification for your investment portfolio, reducing your overall risk when paired with stocks, bonds, and other assets.

Step 1: Define Your Investment Goals

Before you jump into the world of real estate investing, you need to first define your financial goals. Real estate can be a great way to build wealth, but the way you approach it will depend on your unique objectives.

Here are some questions to help you clarify your goals:

- What is your time horizon? Are you looking for quick cash flow, or are you aiming for long-term capital gains?

- What’s your risk tolerance? Real estate investing involves market risks, tenant risks, and maintenance risks. Are you comfortable with those?

- Do you want active or passive investment? Active investing involves buying properties and managing them, while passive investing involves buying shares in real estate funds or REITs.

- What’s your investment capacity? How much capital do you have to get started? Some forms of real estate investing require large initial investments, while others (like REITs) allow you to start small.

Once you have a clear understanding of your goals, you can tailor your real estate investment strategy accordingly.

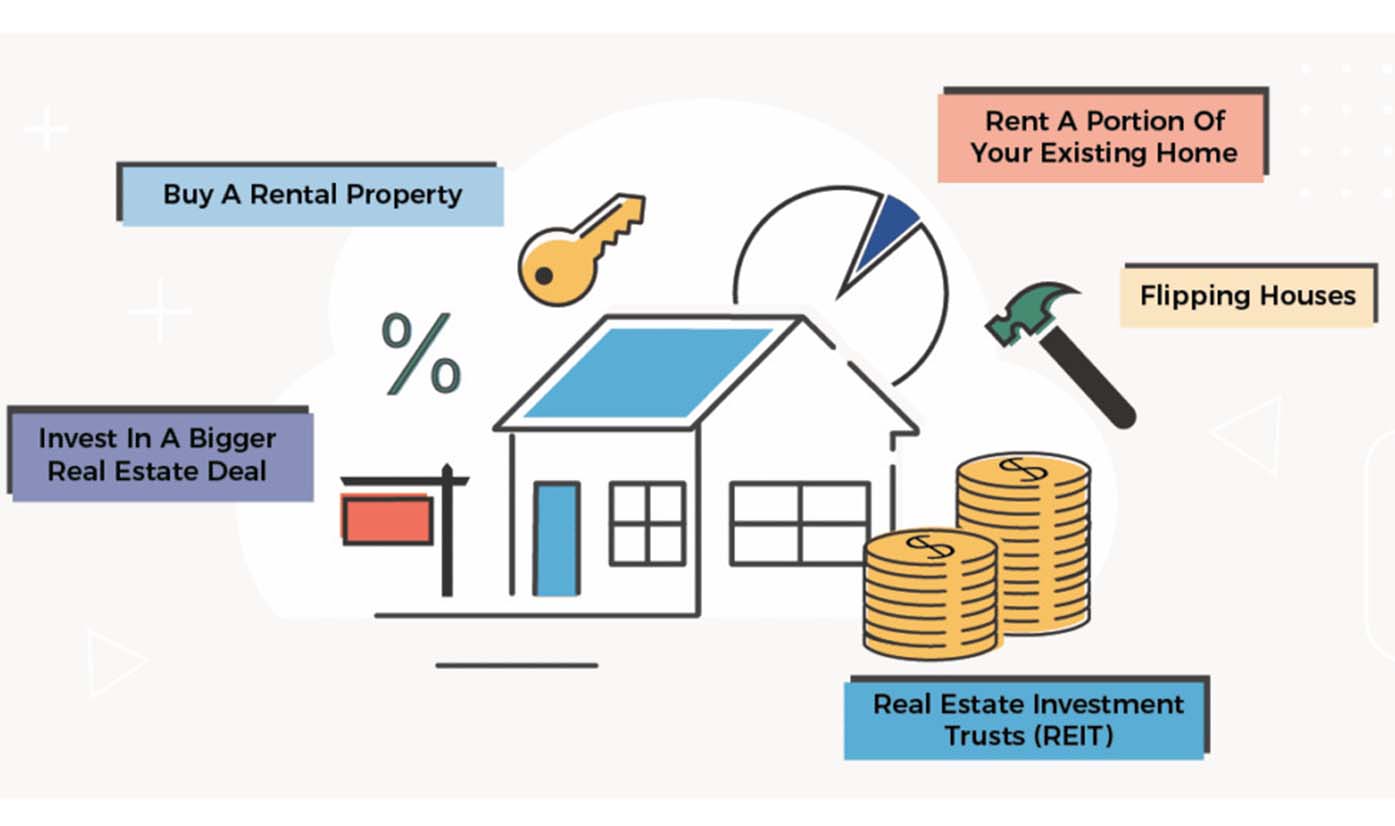

Step 2: Choose Your Real Estate Investment Strategy

There are several strategies to consider when building a real estate portfolio. Let’s break them down so you can make an informed choice based on your preferences and goals.

1. Rental Properties

Owning rental properties—whether residential or commercial—is the most hands-on strategy. With rental properties, you generate income by leasing out the property to tenants. You’ll collect rent, and ideally, after expenses, the property will generate positive cash flow.

Pros:

- Steady passive income from rent.

- Long-term appreciation.

- Tax deductions for mortgage interest, property tax, and maintenance costs.

Cons:

- Initial capital is often high.

- Property management can be time-consuming (though you can hire property managers for a fee).

- Tenant risk: Vacancies, non-payment of rent, property damage.

Who’s this for?

- Investors with time and capital to devote to property management or those willing to hire a property manager.

- Those seeking steady, long-term income and potential appreciation.

2. Real Estate Investment Trusts (REITs)

If you prefer a more passive, lower-barrier-to-entry option, REITs could be the perfect fit. REITs pool capital from investors to purchase, manage, and profit from real estate properties. You can buy shares of a REIT just like stocks, and you’ll receive dividends based on the income generated from the properties they own.

Pros:

- Low capital required to start.

- Liquidity: Buy and sell shares easily on stock exchanges.

- Diversification: REITs hold multiple properties, reducing the risk of individual property investments.

Cons:

- No control over the properties owned by the REIT.

- Market fluctuations can affect the value of REIT shares.

- Potentially lower returns compared to direct property ownership.

Who’s this for?

- Beginner investors or those who want exposure to real estate without dealing with the complexity of direct property ownership.

- Investors looking for passive income with a low entry point.

3. Fix-and-Flip

This strategy involves purchasing distressed properties, renovating them, and selling them for a profit. It’s a popular method among more experienced investors, as it requires knowledge of construction, real estate markets, and sometimes, financing.

Pros:

- High-profit potential in a short period of time.

- Property appreciation from renovations.

- Hands-on experience in the real estate industry.

Cons:

- Requires significant upfront capital.

- Risky: Fluctuating market conditions can affect profits.

- Time-consuming and requires expertise in construction and design.

Who’s this for?

- Experienced investors or those with access to expertise and capital.

- Those with a higher risk tolerance and a desire for quicker returns.

4. Real Estate Crowdfunding

Crowdfunding is a relatively new way for individual investors to pool money to invest in real estate projects, from commercial properties to residential developments. You invest alongside other people, and the profits (or losses) are shared.

Pros:

- Low capital requirements.

- Access to large-scale real estate projects.

- Passive investment.

Cons:

- Liquidity can be an issue as you may be locked in for a set period.

- Risk of platform failure or fraud.

- Less control over specific projects.

Who’s this for?

- Investors looking for a middle-ground between individual property ownership and REITs.

- Those looking to diversify their portfolios with real estate at a lower entry point.

Step 3: Evaluate and Select Properties

Once you’ve decided on your strategy, the next step is selecting specific properties to add to your portfolio. If you’re going for rental properties, here are some key factors to consider:

- Location: Research areas with strong demand for rental properties. Look for proximity to schools, hospitals, transportation, and business districts.

- Condition of the Property: Whether you plan on flipping or renting, the property’s condition is essential. Ensure you have a solid understanding of repair costs.

- Market Trends: Research the real estate market in your area. Are property values appreciating? Are rental rates increasing?

- Cash Flow Potential: Calculate the potential rent income against your mortgage and operating costs to see if the property will generate positive cash flow.

Step 4: Manage and Grow Your Portfolio

After acquiring properties, the next step is effective management. Whether you’re managing a handful of properties yourself or hiring a property manager, regular maintenance and tenant management will be key.

To grow your portfolio, reinvest profits from rental income or sale proceeds into new properties. Over time, your real estate portfolio will compound, and you’ll have more opportunities to diversify and expand.

Building a Real Estate Portfolio That Works for You

Real estate investing isn’t a one-size-fits-all strategy. Whether you’re seeking rental income, diversification, or the thrill of flipping, your path to building a successful real estate portfolio depends on your goals, risk tolerance, and investment horizon. The key is to get started, even if it’s with a small investment, and learn as you go.

If you’re just starting out, consider REITs or crowdfunding as low-barrier ways to enter the market. For those ready to dive deeper, rental properties and fix-and-flips can offer higher returns (with added effort and risk).

Remember that like any investment, real estate comes with risks—but with the right knowledge and a sound strategy, it can be one of the most rewarding ways to build long-term wealth.

So, are you ready to start building your real estate empire? Drop a comment or reach out for more tips on how to get started!