When it comes to retirement planning, one of the most critical concepts that often gets overlooked is asset allocation. While many focus on how much money they need to save or how long they need to work before retiring, asset allocation is the true engine that drives your retirement portfolio’s growth and protects it against the inevitable market fluctuations.

We’ll take an in-depth look at the importance of asset allocation in retirement planning, explore the various asset classes available for your portfolio, and provide practical tips on how to create an asset allocation strategy that aligns with your retirement goals. You’ll have a clearer understanding of why asset allocation is such an important pillar of a successful retirement plan.

What is Asset Allocation?

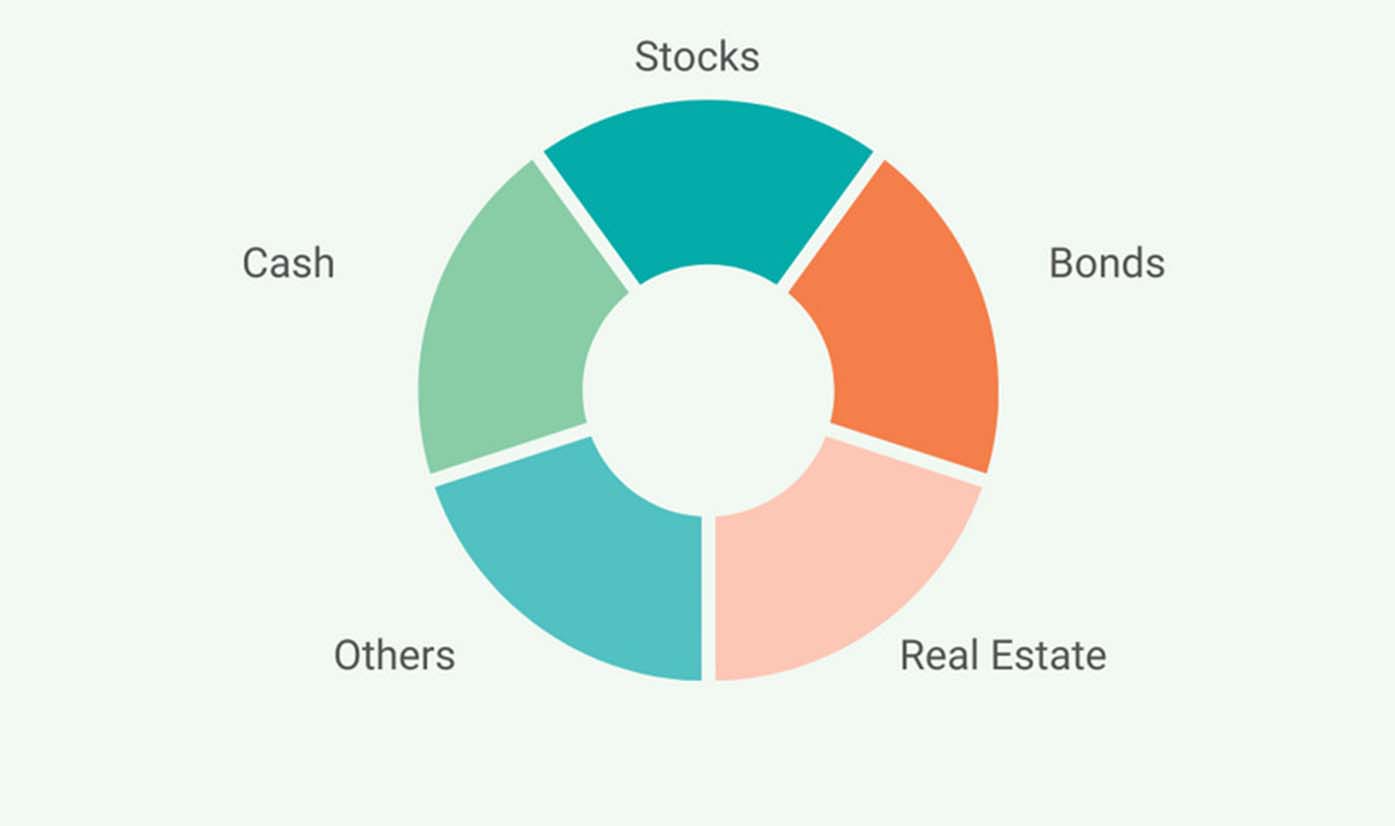

At its core, asset allocation refers to how you distribute your investments across different asset classes, such as stocks, bonds, real estate, and cash equivalents. Each asset class has different levels of risk and return, and the key to a successful investment strategy is balancing these various asset classes in a way that aligns with your risk tolerance, investment timeline, and long-term goals.

The reason why asset allocation is so crucial for retirement planning is because it directly influences both the growth potential and the volatility of your portfolio. For instance, a portfolio heavily weighted in stocks may grow faster, but it’s also more susceptible to market swings. On the other hand, a portfolio skewed towards bonds might offer more stability but grow at a slower rate. The goal is to find a balance that works for your retirement timeline and risk profile.

Why Asset Allocation is Important in Retirement Planning

When you start planning for retirement, your primary objective is to ensure that your investments will generate enough income for you to maintain your desired lifestyle once you stop working. But retirement planning isn’t just about accumulating wealth; it’s about managing risk and ensuring that your assets will support you through the long haul.

1. Risk Mitigation

The most obvious reason to focus on asset allocation is risk reduction. The stock market is notoriously volatile, and no one can predict when the next downturn will happen. By allocating your assets across different types of investments, you minimize the risk that a downturn in one sector will wipe out your entire retirement portfolio.

For example, during an economic recession, stocks may underperform, but bonds and other safe-haven assets like gold or real estate may perform better. This diversification helps cushion the blow of a market downturn and allows your portfolio to recover more quickly.

2. Growth Potential

While risk mitigation is important, it’s not enough to simply protect your portfolio — you also need it to grow. In order to accumulate enough wealth for retirement, your assets need to earn a return. The trick is finding the right balance between risk and reward.

For younger investors or those with a long time horizon before retirement, a portfolio with a higher allocation to stocks (which are historically riskier but offer higher long-term returns) may make sense. On the other hand, as you near retirement age, a more conservative asset allocation — with a heavier emphasis on bonds and cash equivalents — will be important to preserve capital and generate stable income.

3. Cash Flow for Retirement Income

As you approach retirement, your portfolio will need to start generating income to cover your living expenses. This is where asset allocation becomes especially important. A portfolio that is overly weighted in growth assets (such as stocks) may not provide the consistent cash flow you need for daily expenses, while a portfolio focused only on bonds or cash could miss out on growth opportunities.

The goal is to strike a balance where your portfolio continues to grow while also providing reliable income through dividends, interest payments, and other sources of passive income.

4. Inflation Protection

Inflation is a silent killer when it comes to retirement planning. Over the course of decades, even modest inflation can erode the purchasing power of your retirement savings. A diversified portfolio with a mix of asset classes, including stocks, real estate, and commodities, can help protect your savings against inflation. For example, stocks tend to outpace inflation over the long term, and real estate investments often see their value appreciate with rising costs of living.

5. Tax Efficiency

Asset allocation also plays a significant role in minimizing your tax burden. Different assets are taxed at different rates, so by strategically placing assets in tax-advantaged accounts (such as IRAs or 401(k)s) or using tax-efficient strategies, you can reduce your overall tax liability and maximize your retirement savings.

How to Create a Proper Asset Allocation for Your Retirement

Now that we understand why asset allocation is so important, let’s dive into how you can craft the right asset allocation for your retirement portfolio. Keep in mind that your asset allocation will evolve over time as you move closer to retirement, and it should be adjusted to fit your personal financial goals, risk tolerance, and retirement timeline.

1. Assess Your Risk Tolerance

Before you start investing, it’s essential to evaluate your risk tolerance. How comfortable are you with market fluctuations? Do you want high returns with the potential for higher volatility, or are you more risk-averse and prefer stable, predictable returns?

Typically, risk tolerance is broken down into three categories:

- Aggressive: You’re willing to take on more risk for the potential of higher returns. This often means a larger allocation to stocks, particularly growth stocks.

- Moderate: You’re looking for a balance between risk and reward. A moderate portfolio usually has a mix of stocks and bonds.

- Conservative: You prioritize protecting your capital and generating stable income. This usually translates to a higher allocation to bonds and cash equivalents.

A risk tolerance questionnaire, available from most financial institutions, can help you determine your comfort level and guide you in building an appropriate portfolio.

2. Determine Your Retirement Timeline

Your retirement timeline will also play a significant role in determining how to allocate your assets. The more time you have before retirement, the more risk you can afford to take on. The closer you are to retirement, the more you’ll want to focus on preserving your capital and generating income.

As a general rule of thumb, many financial advisors recommend the 100-minus-your-age rule for allocating stocks in your portfolio. For example, if you’re 40 years old, you would have 60% of your portfolio in stocks and the remaining 40% in safer investments like bonds or cash.

3. Diversify Across Asset Classes

Your asset allocation should include a diverse mix of asset classes to reduce risk and increase growth potential. The typical asset classes include:

- Stocks (Equities): Stocks are typically the largest portion of a growth-oriented portfolio. They offer high potential returns but come with more risk. You can diversify across large-cap stocks, mid-cap stocks, and international stocks.

- Bonds: Bonds are more conservative investments that provide steady income. You can choose between government bonds, corporate bonds, and municipal bonds.

- Real Estate: Real estate offers the potential for income and long-term appreciation. It’s an important asset class for inflation protection.

- Commodities: Precious metals like gold and silver can provide protection against market volatility and inflation.

- Cash Equivalents: These include savings accounts, money market funds, and short-term CDs. They offer safety and liquidity but minimal growth.

A well-diversified portfolio across these asset classes helps balance the trade-offs between risk and return.

4. Rebalance Your Portfolio Regularly

As market conditions fluctuate, your asset allocation will naturally shift. This is why it’s important to rebalance your portfolio on a regular basis, typically once or twice a year. Rebalancing involves adjusting your investments back to their original allocation to maintain your desired risk profile.

For example, if your stock holdings perform well, they might make up a larger percentage of your portfolio than you originally intended. To rebalance, you would sell some of the stocks and buy more bonds or other safer assets to restore the original balance.

Asset allocation is one of the most powerful tools in retirement planning. By properly distributing your investments across different asset classes, you can reduce risk, achieve long-term growth, and ensure your portfolio can provide income throughout retirement. Remember that asset allocation is not a one-time task — it requires periodic rebalancing and adjustment as you move through different stages of life.

No matter where you are in your retirement journey, whether you’re just starting or getting close to retirement, it’s essential to understand and implement a strategic asset allocation that aligns with your risk tolerance and financial goals. By taking the time to set up a well-diversified portfolio, you’re giving yourself the best chance at financial independence and a comfortable retirement.