Setting financial goals is more than just a smart way to manage your money—it’s the foundation for achieving long-term financial success. But let’s face it: without a clear plan, those goals can easily become fuzzy or fall by the wayside. That’s where the SMART framework comes in, a simple yet powerful way to break down your financial goals into actionable, measurable steps.

We’ll guide you through how to set SMART financial goals, show you how to pick the right financial products for each goal, and share some practical recommendations for your journey to financial success.

What are SMART Financial Goals?

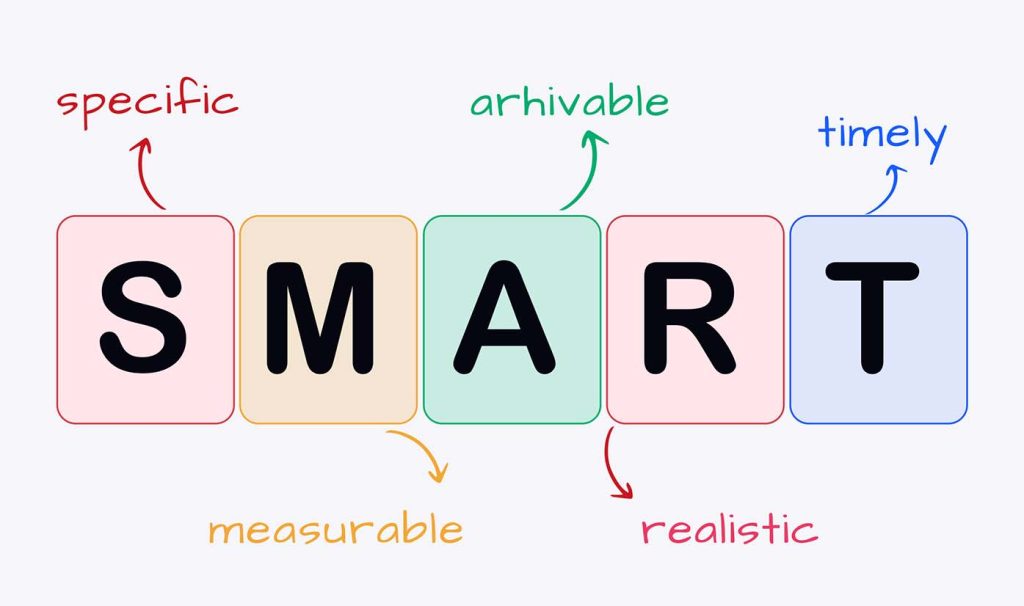

SMART is an acronym that stands for:

- Specific

- Measurable

- Achievable

- Relevant

- Time-bound

By applying these principles to your financial goals, you ensure they are clear, realistic, and within your control. Let’s break down each component:

1. Specific

A specific goal is clear and unambiguous. Instead of saying, “I want to save more money,” make your goal more precise. For example, “I want to save $5,000 for an emergency fund.”

2. Measurable

Measurable goals let you track your progress. This means you should be able to quantify your goal. For instance, “I will save $400 per month for six months to reach my goal of $5,000.”

3. Achievable

While it’s great to aim high, your goals should also be realistic. Setting an overly ambitious goal (like saving $50,000 in a year on a $40,000 salary) can be discouraging. Instead, break larger goals into smaller, attainable steps. For example, saving $400 a month is much more feasible than trying to save $3,000 in one lump sum.

4. Relevant

Your financial goal should align with your broader life priorities. If you’re planning to retire early, your savings goals will be very different than if you’re aiming to buy a house or fund your children’s education. Make sure your goals support your long-term vision.

5. Time-bound

Every goal needs a deadline. Without a timeframe, there’s no sense of urgency. A goal like “I will save $5,000 in one year” creates a clear path forward, giving you an end date to work toward.

Step 1: Defining Your Financial Goals

The first step in setting SMART financial goals is understanding what you want to achieve. Your financial goals will vary depending on your life stage, priorities, and financial situation. Let’s explore some common financial goals and how you might approach them.

1. Emergency Fund: A Safety Net

An emergency fund is often the first financial goal people set because it’s the foundation of financial security. The goal is to have enough saved to cover unexpected expenses, such as medical bills, car repairs, or a job loss.

- SMART Goal Example: “I will save $5,000 in six months to cover 3 months’ worth of expenses.”

- How to Achieve It: Set up automatic transfers to a savings account, track your spending, and cut back on non-essentials to free up more money for savings.

2. Retirement Savings: Building Wealth for the Future

One of the most common long-term financial goals is retirement savings. While Social Security may not be enough to support you in retirement, investing early can lead to significant growth over time.

- SMART Goal Example: “I will contribute $500 per month to my 401(k) for the next 30 years to build a $500,000 retirement fund.”

- How to Achieve It: Start by taking advantage of employer-sponsored retirement accounts (like 401(k)s), especially if your employer offers a match. Additionally, explore IRAs (Individual Retirement Accounts) or Roth IRAs for additional tax advantages.

3. Home Ownership: Investing in Property

If buying a house is on your financial horizon, creating a down payment savings goal is essential. Home ownership offers both personal and financial benefits, including potential property appreciation.

- SMART Goal Example: “I will save $20,000 for a down payment on a house within three years by saving $500 per month.”

- How to Achieve It: Set up a dedicated savings account, explore first-time homebuyer programs, and look for ways to increase your savings, such as cutting back on discretionary spending.

4. Education Fund: Investing in Knowledge

Saving for higher education—whether it’s your own or your children’s—requires careful planning and a long-term commitment.

- SMART Goal Example: “I will save $10,000 for my child’s college education in the next five years.”

- How to Achieve It: Consider tax-advantaged accounts such as a 529 Plan, which allows you to save for education expenses while benefiting from potential tax-free growth.

5. Paying Off Debt: Achieving Financial Freedom

Debt is one of the most common financial burdens, but with a clear strategy, it’s possible to pay off your debt and achieve financial freedom.

- SMART Goal Example: “I will pay off $15,000 in credit card debt within 18 months by making monthly payments of $833.”

- How to Achieve It: Start by prioritizing high-interest debt, like credit cards, then consider consolidating or refinancing options to reduce interest rates. Avoid taking on new debt during this time.

Step 2: Choosing the Right Financial Products to Reach Your Goals

Now that you have a clearer idea of your financial goals, it’s time to select the right financial products to help you achieve them. Here’s a breakdown of some of the best options for common financial goals:

1. High-Yield Savings Accounts

For short-term goals like building an emergency fund or saving for a vacation, a high-yield savings account is a great option. These accounts offer higher interest rates than traditional savings accounts, helping your money grow while remaining easily accessible.

- Recommended Product: Ally Bank High Yield Savings Account or Marcus by Goldman Sachs.

2. Retirement Accounts

When planning for retirement, contributing to a retirement account like a 401(k) or IRA is a must. The tax benefits and compound growth over time can lead to substantial returns.

- Recommended Products:

- Vanguard Target Retirement Funds for automatic diversification based on your target retirement year.

- Fidelity’s 401(k) for employer-sponsored plans with competitive fees and various fund options.

3. Investment Accounts

For medium-term goals (such as buying a home or paying for education), you’ll likely need to invest in stocks, bonds, or mutual funds to grow your wealth faster than a savings account can.

- Recommended Products:

- Vanguard Total Stock Market Index Fund for broad market exposure with low fees.

- Fidelity Flex Mutual Funds for flexible options based on your investment goals.

4. 529 College Savings Plan

If education is your goal, investing in a 529 Plan is an excellent option because of its tax advantages and flexibility for both K-12 and higher education expenses.

- Recommended Product: Fidelity 529 College Savings Plan offers a variety of investment options, including low-cost index funds.

5. Debt Reduction Tools

To achieve debt-free living, you’ll want to consider consolidating high-interest loans or transferring balances to lower-interest credit cards.

- Recommended Products:

- SoFi Personal Loans for consolidating multiple high-interest debts into one lower-interest loan.

- Chase Slate Credit Card for balance transfers with a 0% introductory APR for 15 months.

Step 3: Review and Track Your Progress

Once you’ve set your SMART financial goals and selected your financial products, it’s time to track your progress. Review your goals every few months and adjust your strategy as needed. Life happens, and unexpected expenses or windfalls may require modifications to your plans.

- Monitor Spending: Use apps like Mint or YNAB (You Need a Budget) to track your expenses and savings automatically.

- Adjust Contributions: If you get a raise or bonus, consider increasing your contributions to savings or investments.

- Reevaluate: As your financial situation evolves, revisit your goals and update them to remain aligned with your long-term vision.

Achieving Financial Success with SMART Goals

Setting SMART financial goals is one of the most effective ways to take control of your financial future. By breaking down your goals into specific, measurable, achievable, relevant, and time-bound steps, you’ll create a roadmap that can lead you to financial freedom.

Whether you’re focused on building an emergency fund, saving for retirement, or paying off debt, taking the time to set SMART goals and choose the right financial products will make all the difference. So, what are you waiting for? Start setting your financial goals today—and watch your wealth grow!

Remember, financial success is a marathon, not a sprint. Stay focused, be consistent, and celebrate your progress along the way!