Let’s get one thing straight—life doesn’t always go as planned. Markets crash. Jobs vanish. Unexpected medical bills show up like uninvited guests. And that’s precisely why a financial safety net is not just a good idea—it’s a must.

But here’s the twist: this isn’t just about stuffing cash under your mattress or hoarding gold bars in your backyard. The smart way to build your financial cushion is through strategic asset allocation. Done right, it’s the foundation that protects your wealth during storms and helps it grow during sunshine.

I will walk you through how asset allocation works, why it matters, who needs it (spoiler alert: everyone), and how to select products and strategies to build your bulletproof safety net.

What Is Asset Allocation, Really?

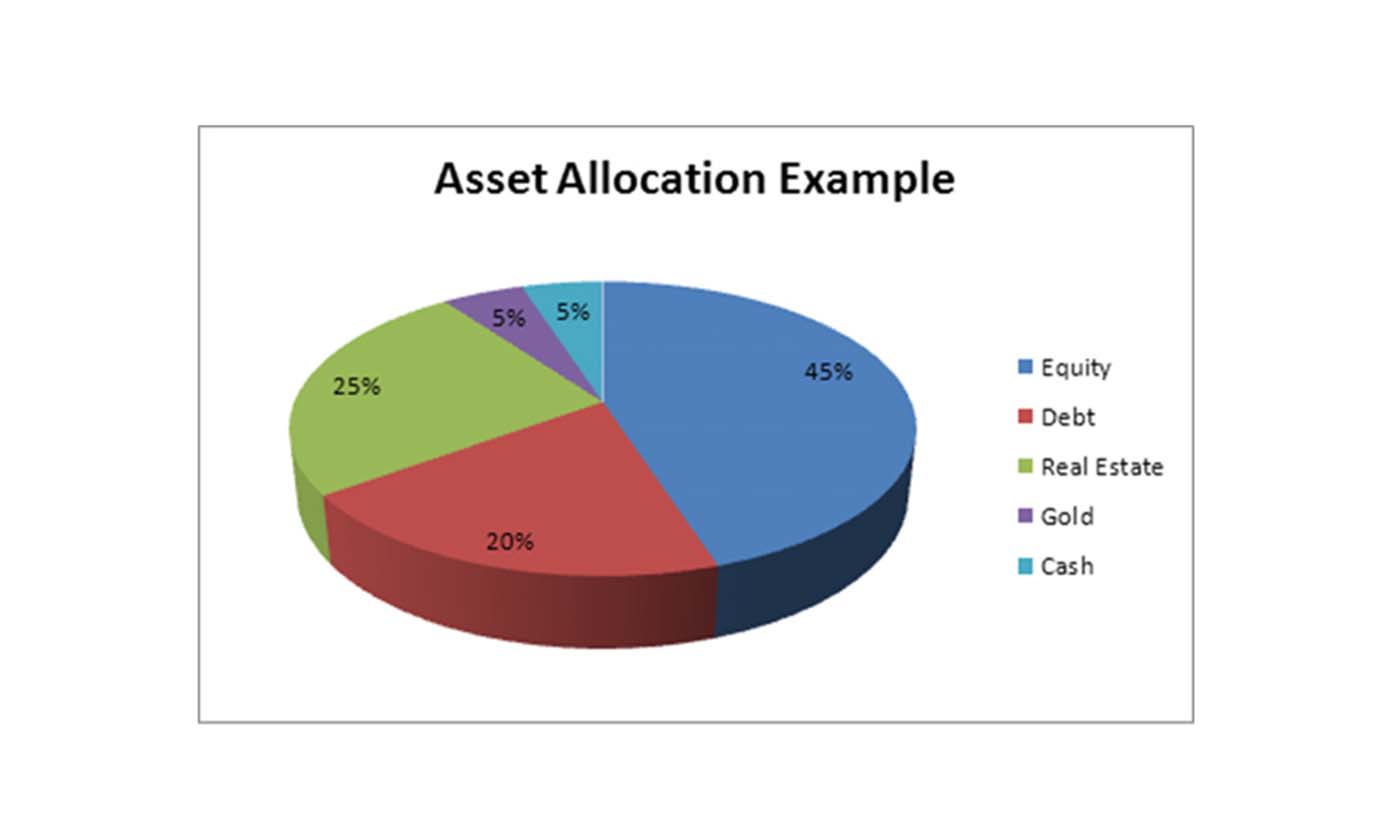

Think of asset allocation as your personal investing recipe. You’re combining different types of financial “ingredients”—stocks, bonds, real estate, cash, maybe even a sprinkle of crypto—into one deliciously balanced portfolio.

The goal? Maximize returns without exposing yourself to too much risk.

In simple terms: don’t put all your eggs in one basket, especially when the market is juggling those baskets on a unicycle during a thunderstorm.

Why Asset Allocation Builds Your Financial Safety Net

Let’s say your entire portfolio is in tech stocks (been there, done that, cried in 2022). If the sector tanks, you could lose a big chunk of your savings overnight.

But what if you had:

- 40% in stocks

- 30% in bonds

- 20% in real estate

- 10% in cash or cash equivalents?

Suddenly, your portfolio can absorb shocks better. Stocks down? Bonds might go up. Real estate might stay stable. And that cash reserve? That’s your panic-free zone.

Diversification through asset allocation is your first line of defense against uncertainty.

Who Should Prioritize Asset Allocation?

Honestly? Everyone—but especially:

• Young Professionals

You’re early in the game and can afford to be more aggressive. But even then, you need balance. A smart mix of growth and stability now sets you up for long-term success.

• Parents and Families

You’ve got college, a mortgage, and maybe braces to pay for. A volatile portfolio is the last thing you need. Asset allocation gives you peace of mind.

• Near-Retirees

Now’s not the time for heroics. A poorly timed market drop could derail decades of saving. A conservative, well-balanced portfolio is crucial.

• Entrepreneurs and Freelancers

With inconsistent income, your investments must act like a backup paycheck. This means allocating assets to generate both growth and income.

How to Choose the Right Mix: The Golden Rule of Allocation

There’s no one-size-fits-all portfolio, but here’s a classic rule of thumb:

100 minus your age = % of portfolio in stocks.

The rest goes into bonds and cash equivalents.

So, if you’re 30, keep 70% in stocks, 30% in lower-risk investments. If you’re 60, go for 40% stocks, 60% safer assets. This keeps your portfolio growing while still cushioning against risk.

Want to get fancy? Adjust for:

- Risk tolerance (are you a rollercoaster lover or prefer a lazy river?)

- Time horizon (when will you need the money?)

- Income stability (stable job = more risk-friendly)

Asset Classes to Consider for a Safety Net

1. Stocks (Equities)

These are your growth engines. But with high reward comes high risk.

Product examples:

- S&P 500 index funds (e.g., VOO, SPY)

- Dividend stocks for income and stability

- Sector ETFs like healthcare or utilities

2. Bonds

The adult in the room. Bonds provide stability and predictable income.

Product examples:

- U.S. Treasury Bonds (ultra-safe)

- Municipal bonds (tax advantages)

- Bond ETFs (e.g., BND, AGG)

3. Real Estate

Real estate often moves differently than the stock market. Plus, it can generate rental income.

Product examples:

- REITs (Real Estate Investment Trusts) like VNQ

- Real estate crowdfunding platforms (e.g., Fundrise)

- Direct property investment if you’ve got the time and capital

4. Cash and Cash Equivalents

Not sexy, but absolutely essential. This is your emergency buffer.

Product examples:

- High-yield savings accounts

- Money market funds

- Short-term CDs

5. Alternatives (Optional)

Gold, crypto, commodities, or private equity—these are wildcards. Keep them minimal unless you really know what you’re doing.

Tip: If you’re adding crypto, keep it under 5% of your portfolio.

How to Rebalance and Maintain Your Allocation

Life happens. Markets shift. One year your stocks soar, the next year they crash. Rebalancing is about realigning your portfolio to your original plan.

Set a calendar reminder to review and rebalance at least once a year.

Example:

If your stocks now make up 80% of your portfolio but your target was 60%, sell some and redistribute to bonds or real estate. Think of it like trimming a bonsai tree—you’re keeping it shaped and healthy.

Tools and Services to Help You

Don’t want to manage this alone? No problem.

• Robo-Advisors

Platforms like Betterment, Wealthfront, or Schwab Intelligent Portfolios automatically allocate and rebalance based on your goals.

• Target-Date Funds

Ideal for retirement planning. These funds automatically shift from aggressive to conservative as you approach a target date (e.g., retirement year).

• Financial Planners

A certified financial planner (CFP) can help customize your asset allocation based on your unique situation.

Build a Net, Not a Cage

A financial safety net isn’t about playing it safe. It’s about being smart enough to survive the worst days so you can thrive on the best ones.

Asset allocation gives your finances structure, stability, and the flexibility to adapt to whatever life throws at you—whether that’s a job loss, a market crash, or an unexpected opportunity.

So start now. Review your current mix. Define your risk level. Pick the right blend of assets that reflects your life, not someone else’s pie chart.

Your future self will thank you—probably from a hammock, on a beach, knowing the safety net is holding strong.